Among the numerous advantages that trading in the forex market offers, perhaps the most significant for many traders consists of the round the clock availability of forex trading during the five day business week.

Specifically, forex trading opens the week in New Zealand on Sunday afternoon at 4 PM EST and then continues trading non-stop until Friday at 5 PM EST when the market closes for the weekend in New York.

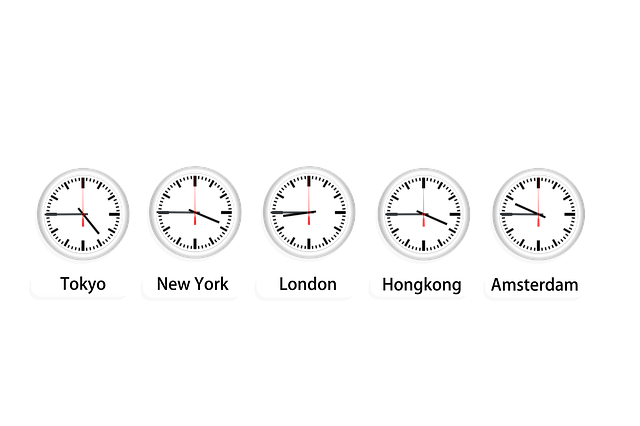

Basically, because different trading centers around the world operate on different time zones, and the forex market is global, the market can trade 24 hours a day. Accordingly, if you are a trader with workaholic tendencies, then trading the forex market might be just the right fit for you!

The following sections cover various aspects related to forex trading times, and all times mentioned below will be expressed as U.S. Eastern Standard Time or EST for consistency.

Time Table for World Forex Markets

Forex trading begins each week with the opening of markets on Sunday in Auckland and Wellington, New Zealand at 4:00 PM. This is followed one hour later by the Sydney open at 5:00 PM. These markets stay open until 1:00 AM and 2:00 AM respectively.

At 7:00 PM, the market in Tokyo opens, followed by Singapore and Hong Kong at 9:00 PM. Tokyo closes at 3:00 AM, while Hong Kong and Singapore close two hours later at 5:00 AM.

The beginning of the European day begins at 2:00 AM, which is when the Frankfurt trading opens. The day in Tokyo then comes to a close at 3:00 AM as London is opening at the same time. London then closes at 11:00 AM.

The European trading day overlaps with the United States beginning when Europe is in full swing at 8:00 AM and continues until London closes at 11:00 AM. Trading in New York then continues until 5:00 PM which brings us once again to the 4:00 PM opening time of New Zealand, followed by Australia at 5:00 PM.

Overlapping Time Zones Increase Liquidity

The periods when different world markets open simultaneously during the day can be the most liquid times to trade for some currency pairs. They also often provide the widest pip range in exchange rate moves from which a speculator can profit.

Essentially, since higher liquidity and more volume tend to benefit speculative forex traders, these overlapping time frames in which trading is usually more active can give the trader an edge to increase profits.

Less Liquid Forex Times to be Aware Of

While the benefits of around-the-clock trading can seem obvious, certain trading times can be considerably less liquid than others. For example, the opening in New Zealand at 4:00 PM often results in a very thin market for an hour or so, at least until trading in Sydney, Australia gets active after 5:00 PM.

Also, between the hours of 5:00 PM and 7:00 PM when Tokyo opens, the only markets open after the New York close are Chicago until 6:00 PM and some West Coast offices of large banks, as well as Sydney and New Zealand.

Also, more caution should be observed when trading in the forex market on Sunday nights and bank holidays, since trading can often be thin during those times.

Fridays can also present an issue for traders since the market generally moves countertrend as positions are squared ahead of the weekend. In addition, key economic numbers are often released on Fridays.