As a whole, currencies make up the most actively traded assets in the world. Almost $6 trillion in different currencies change hands each day in the foreign exchange market, which has become the largest financial market on the planet.

The forex market consists of many participants, some wishing to hedge foreign exchange risk for commercial ventures, while other participants trade the market with the sole intention of making a profit.

Because of the enormous depth of the market and a large number of participants — including a growing number of retail forex traders — no other financial market can offer the profit-making possibilities of the forex market.

Read our Previous Article: The Euro’s Rising Influence

The Incomparable Size of the Forex Market

As mentioned above, the daily turnover in the forex market approximates $6 trillion. This number surpasses the size of the international bond market by a factor of 10 and that of the international equity market by a factor of 50, according to some recent estimates.

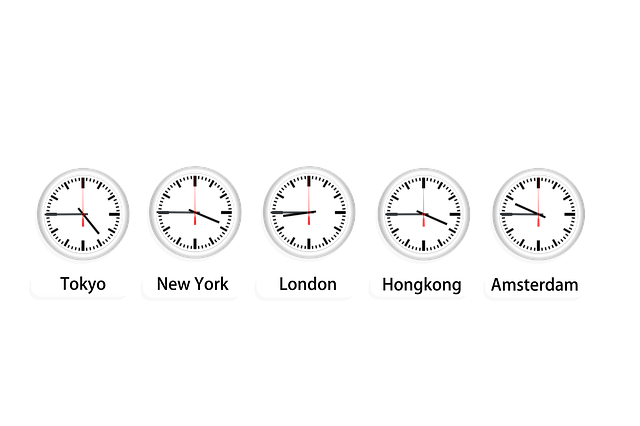

Because of this large size, and the fact that currency trading goes on continuously 24 hours, five days a week, trading in the forex market offers more opportunities than any other market in the world.

Furthermore, trading in the forex market was once limited to large banks, multi-national enterprises, and high worth individuals. Nevertheless, with retail Internet forex brokers, anyone with a computer, an Internet connection and a small amount of money can now trade in the forex market.

With a large number of participants in the forex market and the recent growth provided by the retail market, the resulting liquidity makes for even better trading conditions.

Liquidity and its Benefits in the Forex Market

One of the major reasons that the currencies traded in the forex market has become the most traded asset in the world is because of the high degree of liquidity generally seen in the forex market.

In basic market terminology, the word liquidity refers to the ability to convert an asset into hard cash, as well as the amount of activity which occurs in an asset over a period of time.

For example, the market for real estate would not fit the description of a liquid market. Essentially, owning real estate as an investment will not guarantee that you can liquidate the asset quickly since sometimes it can take years to liquidate real estate.

A spot forex transaction, on the other hand, usually settles within two days of the transaction, and when trading the Canadian Dollar against the U.S. Dollar, spot trades settle in just one day.

Some of the pricing advantages of liquidity consist of lower transaction costs and tighter bid/offer spreads. Also, high liquidity means that large transactions can be handled smoothly and it tends to ensure a more orderly market, with an absence of price vacuums which can cause extreme price swings.